The US is home to an estimated 3,700 property and casualty (P&C) insurance providers, but only a few of the biggest brands dominate the sector. In fact, the nation’s top 25 property casualty insurers control slightly over two-thirds of the market.

These companies have underwritten about $567.8 billion in premiums, according to the latest market share report from the National Association of Insurance Commissioners (NAIC). This figure is a 7% increase from $530.4 billion in the previous year.

Insurance Business names the largest property and casualty insurers in the country in this article. Read on and find out where the industry’s top names rank on the list.

The country’s 25 largest property and casualty insurers have remained consistent over the years, especially in the top 10, with just slight changes in the rankings. These are the companies that made the list ranked by direct premiums written based on NAIC’s latest data.

Direct premiums written: $78.6 billion

Direct premiums earned: $75.1 billion

Loss ratio: 82.24%

Market share: 9.06%

State Farm remains the biggest industry player, underwriting premiums nearly $23 billion more than its nearest competitor. The Bloomington, Illinois-headquartered P&C giant offers a range of auto, home, and small business policies. It also has a robust life, health, and disability insurance portfolio.

State Farm has a nationwide network of 19,000 agents whom policyholders can turn to in times of need – just like a good neighbor.

The company is known for offering competitive auto insurance rates. It also helps that the insurer consistently scores above the industry average when it comes to customer satisfaction.

Its policies can be accessed directly or through its network of insurance agents.

If you’re wondering how much State Farm agents make, this guide will give you the answers.

Direct premiums written: $56.0 billion

Direct premiums earned: $54.9 billion

Loss ratio: 77.05%

Market share: 6.45%

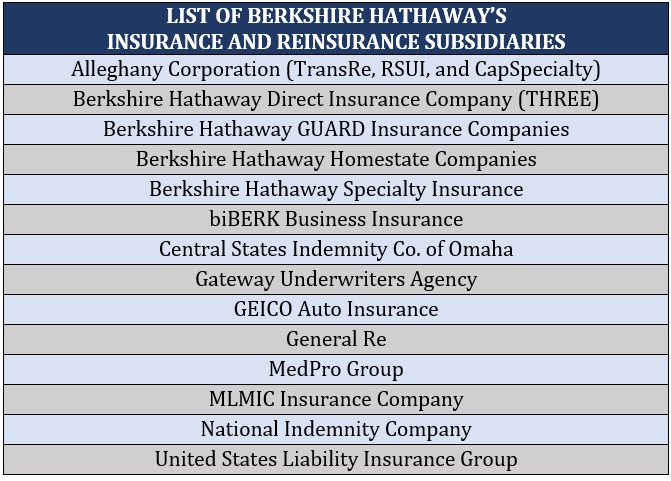

The name behind popular car insurance brand GEICO, Berkshire Hathaway owns several other insurance and reinsurance subsidiaries consisting of property casualty insurers and life and health specialists. These companies are listed in the table below:

Warren Buffet, Berkshire Hathaway’s chairman and chief executive officer, is considered the wealthiest insurance tycoon in the US. The man who is known as the “Oracle of Omaha” sits among the leaders of Forbes’ billionaires list with a net worth of more than $120 billion.

Direct premiums written: $52.3 billion

Direct premiums earned: $50.6 billion

Loss ratio: 70.22%

Market share: 6.03%

Progressive is the second largest auto insurance company in the country – trailing only State Farm – but ranks number one in the motorcycle and specialty RV segment. The Ohio-based property casualty insurer also offers a range of personal and commercial policies, as well as financial services. Its insurance products can be accessed directly or through its nationwide network of 38,000 independent agents.

Direct premiums written: $45.5 billion

Direct premiums earned: $43.8 billion

Loss ratio: 75.39%

Market share: 5.24%

Allstate is among the largest publicly traded personal lines insurers in the country, with around 16 million policyholders and 175 million policies in-force. The company offers a range of coverage under the commercial, life, property, and vehicle segments. It is also the name behind popular insurance brands Encompass, Esurance, and Answer Financial.

Allstate policies are sold primarily through the company’s exclusive agencies. The firm has about 12,300 agents and financial representatives across the US and Canada.

Direct premiums written: $43.9 billion

Direct premiums earned: $42.6 billion

Loss ratio: 63.63%

Market share: 5.06%

The fifth largest property and casualty insurer is also the biggest mutual insurer on the list. Liberty Mutual offers a range of insurance products and services, including:

Boston-headquartered Liberty Mutual also ranks third in the country’s list of the 10 largest home insurance providers.

Direct premiums written: $34.2 billion

Direct premiums earned: $32.7 billion

Loss ratio: 57.79%

Market share: 3.95%

Travelers is the largest provider of commercial policies and workers’ compensation insurance in the country, controlling 8% and 6% of the respective overall markets. The company’s property and casualty insurance products are directly sold to consumers or through its network of 13,500 independent agents. Apart from the US, Travelers operates in Canada, Ireland, and the UK.

Direct premiums written: $29.4 billion

Direct premiums earned: $28.6 billion

Loss ratio: 57.77%

Market share: 3.39%

Global insurance giant Chubb ranks not only among the country’s top property casualty insurers, but it is also one of the largest insurance companies in the world based on market cap. The company operates in more than 50 countries and territories.

Chubb offers a range of commercial and personal P&C insurance policies. It is also one of the leading commercial lines insurers in the US.

Apart from property and casualty products, the company underwrites life, personal accident, and supplemental health insurance, and reinsurance. Almost 40% of Chubb’s business is transacted outside the country.

Direct premiums written: $26.8 billion

Direct premiums earned: $26.0 billion

Loss ratio: 83.55%

Market share: 3.09%

USAA caters exclusively to members of the armed forces, reserves, veterans, and their families. Still, it ranks among the country’s largest home and auto insurance providers. The company consistently gets the highest ratings in customer satisfaction surveys, with scores often way above the industry average.

USAA is also known for offering competitive premiums. It is likewise among the best insurance companies to work for in the country.

Direct premiums written: $26.4 billion

Direct premiums earned: $25.7 billion

Loss ratio: 64.47%

Market share: 3.04%

Farmers consists of three reciprocal insurers, meaning they are owned and governed by policyholders. These are:

Along with their subsidiaries and affiliates, these insurers make up one of the largest property casualty insurers in the US.

Farmers offers policies for homes, vehicles, and small businesses. To date, the company employs more than 48,000 captive and independent agents, serving over 10 million households. It has also written more than 19 million individual insurance policies across all 50 states.

Want to know how much Farmers insurance agents make? Check out this guide.

Direct premiums written: $20.3 billion

Direct premiums earned: $19.8 billion

Loss ratio: 66.07%

Market share: 2.34%

Nationwide provides a range of insurance and financial services to clients across the US. Its P&C portfolio includes auto, motorcycle, homeowners, pet, farm, renters, and commercial insurance. The company also offers life insurance, annuities, mutual funds, retirement plans, and specialty health services.

Direct premiums written: $17.5 billion

Direct premiums earned: $16.8 billion

Loss ratio: 66.94%

Market share: 2.02%

Global multiline insurer Zurich boasts a robust portfolio of property and casualty insurance products. Its personal lines offerings include car, home, general liability, and travel insurance. The insurance giant also provides a range of commercial insurance policies that cover cyber risks, financial institutions, professional liability, marine, and trade credit.

Besides P&C policies, Zurich offers life insurance, claims management, risk engineering, and captive services. It has a global reach spanning more than 210 countries and territories.

Direct premiums written: $15.1 billion

Direct premiums earned: $15.0 billion

Loss ratio: 57.16%

Market share: 1.74%

Global insurer American International Group, more popularly known as AIG, offers a range of commercial and personal insurance policies. It offers liability, specialty, financial lines, accident, and health insurance, as well as crop risks services to clients in the US. The company operates in more than 70 countries and has $257 billion in total assets.

Direct premiums written: $14.6 billion

Direct premiums earned: $14.1 billion

Loss ratio: 54.27%

Market share: 1.69%

Property and casualty insurance is among The Hartford’s three major business units, which include group benefits and mutual funds. The company holds a partnership with AARP, exclusively providing home and auto policies to the association’s members since 1984.

The Hartford’s home insurance portfolio consists of homeowners, condo, and renters’ policies. Its auto coverage lineup, meanwhile, includes insurance for classic cars, ATVs, boats, golf carts, RVs, and snowmobiles. The company also offers commercial policies catering to a wide range of industries, including education, healthcare, manufacturing, retail, and technology.

Direct premiums written: $14.1 billion

Direct premiums earned: $13.2 billion

Loss ratio: 74.68%

Market share: 1.62%

American Family Insurance ranks in the top 10 of the country’s largest home and auto insurance companies and among the nation’s leading property casualty insurers. Also known as AmFam, the company boasts an excellent track record when it comes to customer satisfaction. The availability of its policies, however, is limited to certain states.

The AmFam Group consists of several businesses. These are listed on the table below.

Direct premiums written: $12.7 billion

Direct premiums earned: $12.1 billion

Loss ratio: 57.53%

Market share: 1.47%

CNA Insurance provides commercial insurance and risk management solutions customized to meet the needs of different businesses. Its portfolio includes commercial auto, marine, liability, workers’ compensation, and cyber insurance. The company is also among the 10 largest cyber insurance providers in the country. CNA has offices in more than 70 locations in the US, Canada, and Europe.

Direct premiums written: $11.2 billion

Direct premiums earned: $10.9 billion

Loss ratio: 62.06%

Market share: 1.29%

Tokio Marine is a Tokyo-headquartered P&C specialist operating in 46 countries, including the US, where it ranks among the top property casualty insurers. While the majority of the insurance giant’s 41,000-strong workforce is based in Japan, about a third serves global clients. Some brands under the company are Tokio Marine North America, Philadelphia Insurance, Delphi Financial, and Nisshin Fire & Marine.

Tokio Marine’s portfolio includes aviation, personal lines, surety, professional lines, accident and health, and commercial insurance.

Direct premiums written: $11.0 billion

Direct premiums earned: $10.4 billion

Loss ratio: 71.60%

Market share: 1.27%

Michigan-based Auto-Owners Insurance is among the country’s largest property casualty insurers. It offers auto, home, life, and business policies to about three million policyholders in 26 states. The company’s products are distributed through its network of 48,000 licensed insurance agents.

Direct premiums written: $9.4 billion

Direct premiums earned: $8.7 billion

Loss ratio: 54.58%

Market share: 1.09%

Toronto-based financial holding firm Fairfax Financial offers a range of property and casualty insurance and reinsurance products. It also provides investment and insurance claims management services.

In the US, Fairfax operates several subsidiaries that give clients access to a range of P&C solutions. These companies include:

Fairfax also ranks second among the largest cyber insurance providers in the US.

Direct premiums written: $8.8 billion

Direct premiums earned: $8.3 billion

Loss ratio: 51.42%

Market share: 1.01%

W.R. Berkley provides commercial P&C insurance and reinsurance products to niche market clients in the US and overseas. Its insurance segment underwrites excess and surplus lines to cover complex risks and admitted insurance products to support the unique exposures of each client. W.R. Berkley’s reinsurance segment, meanwhile, helps insurance companies and self-insured businesses manage their net risk by covering their excess.

Direct premiums written: $8.6 billion

Direct premiums earned: $8.2 billion

Loss ratio: 78.35%

Market share: 0.99%

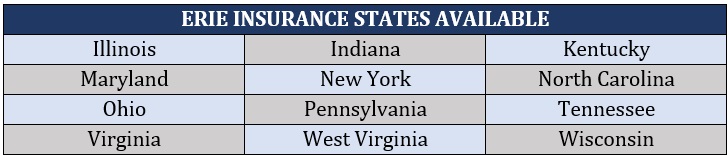

Erie Insurance offers auto, home, business, and life insurance policies through its network of more than 13,000 independent agents. Its products are available in 12 states and the District of Columbia. These states are:

Erie Insurance has more than six million auto, home, and business policies in-force.

Direct premiums written: $8.5 billion

Direct premiums earned: $8.3 billion

Loss ratio: 53.48%

Market share: 0.98%

American Financial Group is a Cincinnati-based holding firm that operates two key segments: insurance and investments. Its insurance unit offers a range of property and casualty policies tailored to suit the needs of various businesses.

The company boasts among the oldest P&C operations in the US, which started in 1872.

Direct premiums written: $8.3 billion

Direct premiums earned: $7.9 billion

Loss ratio: 55.87%

Market share: 0.96%

Another global holding firm, Markel Corporation’s operations consist of insurance, reinsurance, and investments. The company has 16 subsidiaries operating through 80 locations in about 20 countries.

Markel’s core business is specialty insurance, which is delivered through its Markel Assurance, Markel Specialty, and Markel International brands. Its reinsurance products, meanwhile, are offered via the Markel Global Reinsurance brand.

Direct premiums written: $8.2 billion

Direct premiums earned: $7.9 billion

Loss ratio: 60.88%

Market share: 0.95%

Assurant is a global provider of risk management products and services focused on the lifestyle and housing protection markets. Its insurance segments consist of:

Assurant is active in more than 20 countries. It employs more than 15,600 staff worldwide.

Direct premiums written: $7.4 billion

Direct premiums earned: $7.2 billion

Loss ratio: 85.19%

Market share: 0.85%

Sompo is an international insurance and reinsurance provider that offers property and casualty and life and health insurance. The firm also provides asset management and home remodeling services. Sompo’s key segments consist of domestic P&C, overseas insurance, domestic life, and nursing care and healthcare. Apart from the US, it holds operations in Australia, Brazil, China, India, Indonesia, Japan, Singapore, Turkey, and the UK.

Direct premiums written: $7.4 billion

Direct premiums earned: $7.2 billion

Loss ratio: 85.19%

Market share: 0.85%

QBE provides general insurance and reinsurance products to clients in more than 140 countries. Its North American division offers a range of specialty, commercial, personal, and crop insurance. The unit holds headquarters in New York.

You can find the meaning behind the most common industry buzzwords in our glossary of insurance terms.

The US insurance industry wrote a total of $1.48 trillion worth of premiums in 2022, according to the latest data from the Insurance Information Institute (Triple-I). Premiums recorded by property casualty insurers accounted for 53%, while those from health and life insurers made up the rest.

P&C insurance includes auto, homeowners, and commercial policies. Premiums written for the sector totaled $776.7 billion last year.

The life and annuity insurance sector, meanwhile, includes annuities, accident and health, and life insurance. Premiums for the sector amounted to $698.5 billion in 2022.

In terms of employment, the insurance industry’s workforce totaled 2.9 million people during the period. Of those, 1.6 million worked for insurance companies, including:

The remaining 1.3 million people worked for insurance agencies, brokers, and other insurance-related enterprises.

If you’re planning to join the insurance industry workforce, the fastest way to search for a role that matches your skills is through employment websites. You can check out the best websites for finding insurance jobs in this article.

What do you think of the top property casualty insurers on our list? Have you experienced working with them? We’d love to see your story in the comments section below.