A House committee approved legislation Wednesday that would prevent the Federal Insurance Office from compelling insurers to provide information to the agency.

The bill, the Insurance Data Protection Act, would eliminate the subpoena power of the FIO and the Office of Financial Research. It also would establish confidentiality procedures for non-public data and would require the FIO to coordinate with state insurance regulators when trying to collect information.

The House Financial Service Committee voted along partisan lines, 28-22, to advance the bill to the full House. The strong push back from committee Democrats may make it harder to take up on the House floor. The Senate has not acted on a companion bill.

Backers of the bill said it prevents the FIO from encroaching on the turf of state insurance regulators. Under the McCarran Ferguson Act of 1945, insurance regulation was delegated to the states. The Dodd-Frank financial reform law in 2010 established the Federal Insurance Office after insurance firms took a big hit in the 2008-09 financial crisis and required a federal bailout, according to an Investopedia analysis.

The FIO advises the Treasury secretary on insurance matters, including access to insurance products by underserved communities and consumers.

In October 2022, the FIO proposed to collect climate-related information from insurers to assess the impact of climate disasters on insurance consumers. It was acting on a government-wide Biden administration directive to address climate change.

Last month, the National Association of Insurance Commissioners launched its own data call on property and casualty insurance and said it would share its information with the FIO, which abandoned its own collection effort.

The FIO’s move toward data collection has riled Republicans and others who want to maintain state hegemony of insurance regulation. That resistance – in legislative form – is headed toward the House floor.

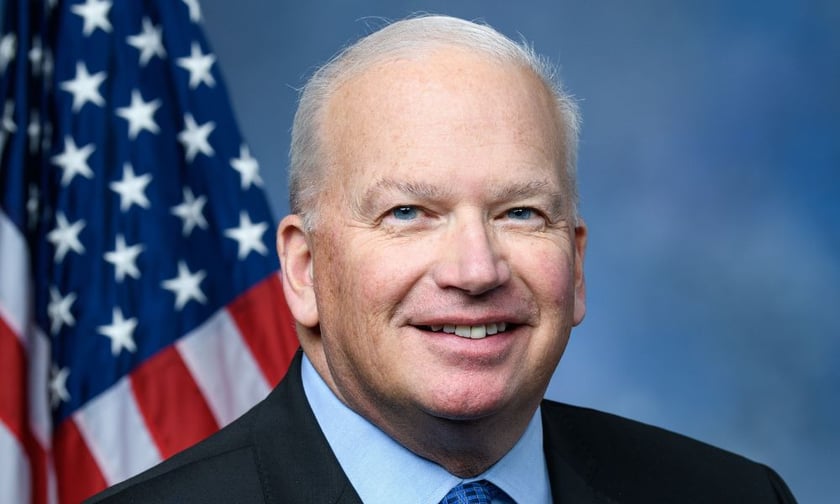

“State regulators have a unique understanding of the challenges of risk that face their respective states regarding climate,” the bill’s author, Rep. Scott Fitzgerald (pictured top), R-Wisc., said during a committee meeting. “Their experience and knowledge in this space is much more valuable in assessing climate risk than that of bureaucrats in Washington. The mere threat of a subpoena incentivizes the insurance office to go around the states by issuing overly broad data calls that may not adequately protect consumer information.”

An FIO spokesperson was not immediately available for comment.

Democrats argued that the FIO needs subpoena power to give it the latitude to monitor the affordability and availability of insurance to underserved communities and to assess potential systemic financial risk in the insurance industry.

“As we face growing threats posed by the climate crisis and other factors, such as ongoing inflation, now is not the time to weaken the federal government’s tools to monitor industry trends,” said Rep. Maxine Waters, D-Calif. (pictured immediately below) and ranking member of the committee.

Mark6mauno, This file is licensed under the Creative Commons Attribution 2.0 Generic license.

The NAIC data collection effort is “crucial to mitigating the effects of climate change on the insurance industry,” Waters said. But if states refuse to provide data, “FIO must have the ability to collect the data it needs to carry out its mandated monitoring duties. To date, FIO has not had to use its subpoena authority. But it is a critical tool that must be preserved.”

Republicans want to rein in FIO. Rep. Warren Davidson (pictured immediately above), R-Ohio, said the agency seeks to expand its power.

“It’s like a noxious weed,” Davidson said. “If you don’t contain it, it’s spreading out. People at the Federal Insurance Office are trying to grab power they were not granted” by the Dodd-Frank law.

But Rep. Sean Casten, D-Ill., said climate change doesn’t respect state lines, and the risk in each state must be illuminated. Achieving that kind of transparency requires an unfettered FIO.

“If we were to pass this bill into law, the practical effect would be to make our financial regulators dumber, to expose us to systemic financial risks in our economy and every one of us who voted for this bill would be accountable for that outcome,” Casten said.

Pic: Gage Skidmore, Attribution-ShareAlike (CC BY-SA 2.0)